The Psychology of Subscription Addiction and Impulse buying | How to Overcome It

Subscription addiction and impulse buying are two common issues that many people face in their daily lives. While these behaviors can be beneficial in small doses, they can become costly and problematic when taken to excess.

This article will explore the psychological factors behind subscription addiction and impulse buying, as well as strategies for overcoming them. By gaining an understanding of the underlying psychology behind these behaviors, it is possible to make better choices when it comes to spending money.

Subscription Addiction

Subscription addiction is a psychological disorder characterized by an impulse to purchase and use large amounts of subscription services, products, or memberships. This behavior involves compulsive purchasing that may result in financial difficulties and a sense of being unable to cope.

Impulse Buying as a Related Behavior

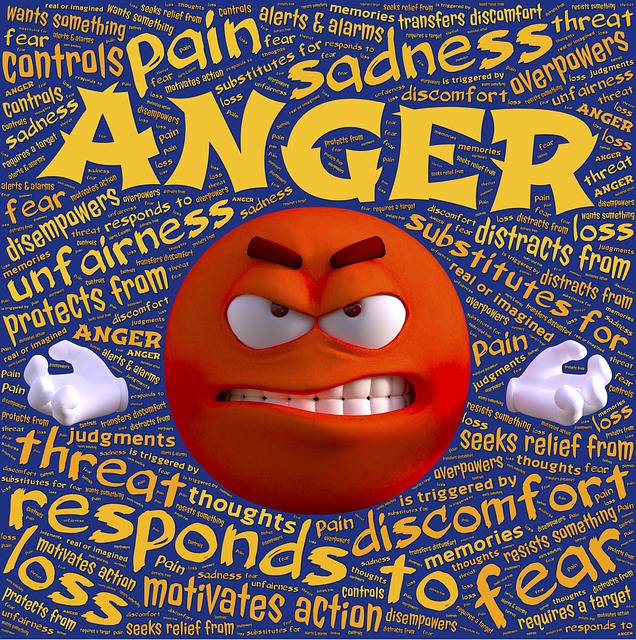

Impulse buying is a related behavior to subscription addiction in which consumers make unplanned purchases without considering the consequences. This type of spending often leads to financial strain and regret. Research has found that these behaviors are driven by emotions such as anxiety , depression, and stress.

Psychological Factors Contributing to Subscription Addiction

Psychological factors include a need for immediate gratification, a lack of self-control, and a tendency to avoid discomfort.

Instant Gratification and Rewards

This can be a major factor in subscription addiction and impulse buying. Subscription services often offer immediate rewards or features that users want or need, which encourages them to keep purchasing the service. Overtime, this can lead to an addictive cycle of using the service to get temporary satisfaction, only to find themselves wanting more.

Fear Of Missing Out (FOMO)

FOMO is a psychological phenomenon that can lead to an uncontrollable urge to buy subscriptions and impulsively purchase unnecessary items. FOMO is often caused by the desire to fit in or feel connected with others, as well as the fear that valuable opportunities may be missed out on if one does not act quickly. These feelings, combined with the ease of purchasing online , can make it difficult to resist the temptation of buying items that are not actually needed.

Cognitive Biases and Decision-Making Processes

Many of us make decisions based on cognitive biases that can lead to poor spending habits. Cognitive biases refer to systematic errors in our thinking that can lead us to make decisions or form beliefs that are not necessarily correct. These biases can be especially detrimental when they come into play during our decision-making processes involving money, as they can lead us to make irrational purchases that we later regret.

Psychological Factors Contributing to Impulse Buying

It is important to understand the psychological factors underlying this behavior so that you can better control

Emotional Triggers and Impulsive Behavior

They are often fueled by emotional triggers. When we experience certain emotions, like loneliness or boredom, we may seek out short-term gratification through the purchase of a product or service. This behavior is driven by our brain’s reward system, which rewards us with feelings of pleasure when we buy something. Unfortunately, this behavior can become compulsive and have a negative impact on our financial health.

Social Influence and Peer-Pressure

It can be influenced by social factors, such as peer pressure. For example, when people see their peers buy something they want or subscribe to something that looks fun or useful, they may feel pressure to do the same. This can lead them to subscribing to services, buying things on impulse, and spending more than they should.

The Role of Advertising and Marketing Tactics

Advertising and marketing tactics play an important role in influencing consumers to purchase subscription services and products. Specific marketing tactics, such as utilizing influencers and celebrity endorsements, can encourage people to make purchases they may not otherwise have made. Advertising also plays a role in creating the perception of value for products, which can lead to impulse buying decisions.

The Consequences of Subscription Addiction and Impulse Buying

They can be detrimental to your financial and emotional health. It is important to understand the consequences of these behaviors before they cause serious damage in someone’s life.

Accumulating Debt and Financial Stress

The thought of accumulating debt can be terrifying to many people. With the rise of subscription addiction and impulse buying, it is easier than ever to fall into a trap of debt. The psychological pattern of overspending can leave you feeling helpless and overwhelmed.

Overspending and Budget Constraints

Overspending can be a major obstacle to effective budgeting. When people are not careful with their money, they often find themselves overextended and unable to meet their financial goals. Overspending can lead to debt, stress, and other financial problems that can be difficult to overcome.

Regret and Buyer’s Remorse

Regret and buyer’s remorse are common emotions experienced by people who have become addicted to subscription services or have a habit of impulse buying. This feeling of regret is often associated with feelings of guilt, shame, anxiety, and depression when people realize they have spent more money than they can afford on products and services that they don’t necessarily need.

Increased Stress and Anxiety

For many people, this causes a sense of increased stress and anxiety. This is because the act of spending money on something that may not be necessary or beneficial in the long run may leave them feeling overwhelmed and out of control. This can be especially true when it comes to subscriptions, as they often come with hidden fees or require a commitment that can be hard to break away from.

Overcoming Subscription Addiction and Impulse Buying

They can be a difficult habit to break, but it is possible to overcome these behaviors with a little bit of knowledge and dedication.

Recognizing the Problem

It can be hard to recognize when you’re struggling with subscription addiction or impulse buying. But when those purchases start costing more than you can afford, or they’re no longer serving their original purpose – like when you sign up for a music streaming service but never listen to it – it’s time to take a step back and evaluate the situation.

Identifying signs of addiction and impulsive buying behavior

Identifying signs of addiction and impulsive buying behavior can be tricky, especially if the individual is in denial. When it comes to shopping, there are certain behaviors that can be warning signs of an addiction and impulse buying problem. Shopping addiction is a real disorder that affects millions of people around the world. It can have devastating impacts on relationships, finances, and mental health.

Self-reflection and understanding personal triggers

When attempting to manage subscription addiction or impulse buying, the first step is to reflect on why you are engaging in these behaviors. Analyzing both external and internal motivators behind purchases can provide insight into why they are appealing and how to avoid them in the future. Additionally, understanding your personal triggers, such as ads or peer pressure, can help you avoid situations and experiences that may lead to impulse spending.

Developing Self-Control and Mindful Consumption

Developing self-control and mindful consumption can be a powerful way to overcome subscription addiction and impulse buying. Self-control is the ability to resist temptation and make decisions that are in line with one’s long-term goals instead of short-term gratification. Mindful consumption is the practice of being aware of the impact of our purchases, both on ourselves and on the environment.

Setting clear financial goals and creating a budget

Financial goals are essential in helping individuals stay within their means and prevent them from becoming addicted to subscription services or engaging in impulse buying. Without clear financial goals, it can be easy to fall into the habit of spending money on items that you don’t need, leading you further away from your financial goals.

Practicing delayed gratification and impulse control techniques

Practicing delayed gratification and impulse control techniques can be beneficial in overcoming subscription addiction and impulse buying. Delayed gratification is the practice of resisting immediate satisfaction in order to gain a greater reward later. Impulse control techniques, such as meditation or deep breathing, can help one become aware of and manage impulsive behaviors.

Breaking the Cycle

Subscriptions and impulse purchases can have negative effects on your budget. However, with dedication and self-awareness, it is possible to break the cycle. Here are some steps to take.

Assessing and evaluating existing subscriptions

When it comes to assessing and evaluating existing subscriptions, it is important to recognize that our psychological state of mind can play a huge role in our shopping habits. It is important to take the time to assess your current subscription services and determine if they are truly serving you in a meaningful way or if they are simply a source of entertainment and distraction.

Cancelling unnecessary subscriptions and reducing consumption

Cancelling unnecessary subscriptions will help you to be conscious of what you are spending your money on. It’s easy to lose track of how much money we are spending on subscriptions if they are not actively managed.

Seeking support from friends, family, or support groups

To overcome unhealthy shopping habits, seek support from friends, family, or support groups. They can provide emotional support and accountability. Support groups offer a safe space to discuss and learn from others facing the same challenges. Changes in behavior take time, but seeking help is a great first step.

Building Healthier Consumption Habits

To overcome these issues, it is important to understand the psychology behind them and learn how to build healthier consumption habits.

Researching before making purchasing decisions

Impulse purchases are often made on a whim, without much consideration for the potential consequences of the decision. Researching can help to prevent this by providing an opportunity to compare prices, read customer reviews, and investigate any potential drawbacks associated with a product or service.

Establishing rules for evaluating new subscriptions

In order to prevent subscription addiction and impulse buying, it’s important to establish rules for evaluating new subscriptions. Before signing up for a new subscription or committing to any purchase, it’s important to take the time to evaluate the cost-benefit of the service or item. Taking into consideration factors such as cost, convenience, value, and need can help you make an informed decision about whether or not the purchase is worth it.

Engaging in alternative activities and hobbies

Finding something that gives you joy outside of shopping or purchasing items is a great way to help reduce your desire to overspend. By nurturing other interests, such as pursuing a hobby or taking up a sport, you can help to reduce the urge to buy impulsively. Additionally, engaging in activities that don’t require spending money can also provide an outlet for managing stress and anxiety.

Conclusion

In conclusion, understanding the psychology behind subscription addiction and impulse buying is the first step to overcoming it. By recognizing your triggers, setting a budget, and practicing mindful consumption, you can take control of your spending habits and find a healthier balance. Remember, it’s never too late to make a change and prioritize your financial well-being.