Simplify Your Finances with a Subscription Tracker

Do you find yourself overwhelmed with the number of subscriptions you have taken up over time and the ones that automatically renew without your notice?

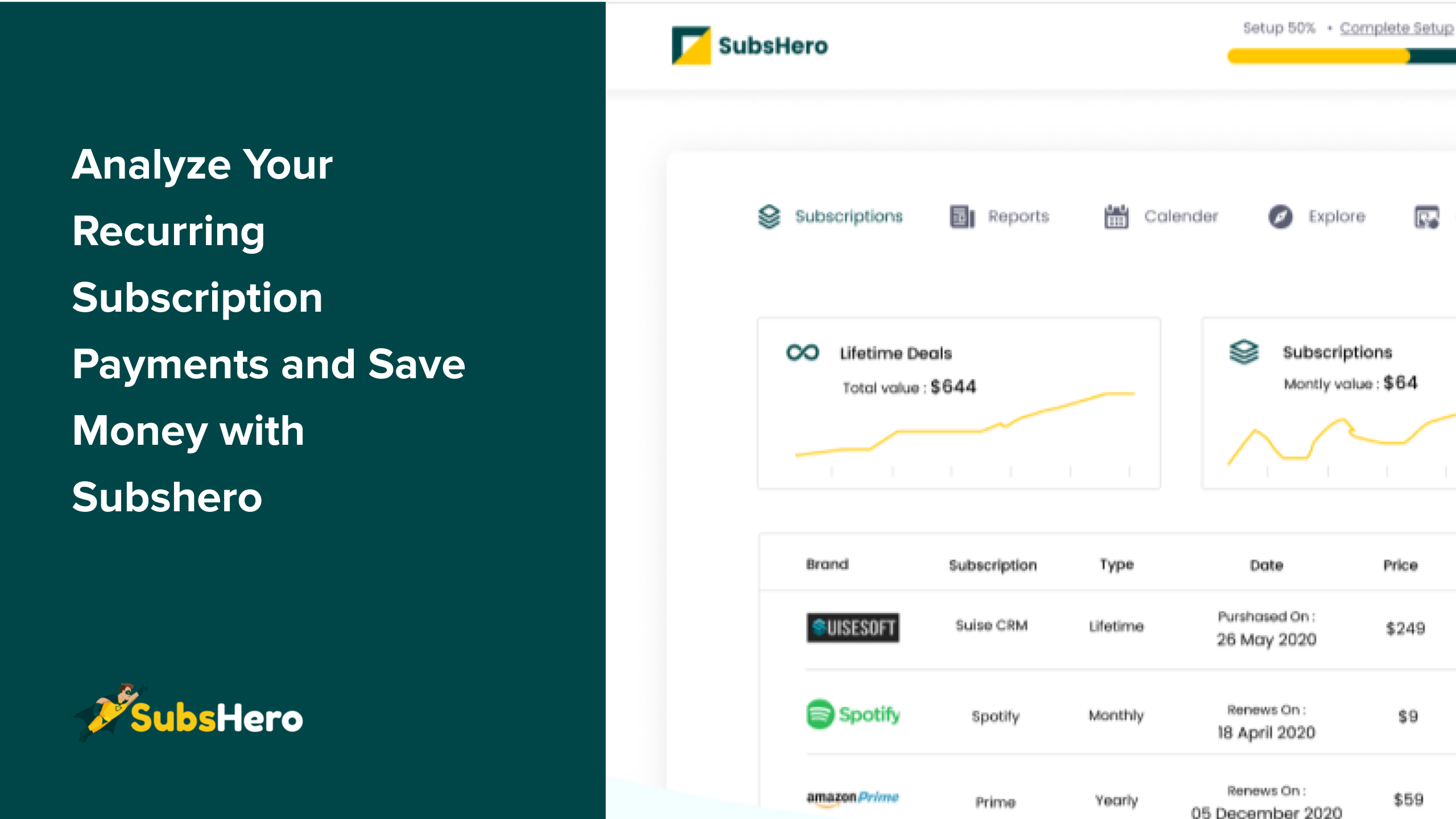

With so many payment dates to remember, it can be challenging to keep track of them all. Enter Subscription Tracker- a finance tracking tool that simplifies your life by managing all your subscriptions in one place.

In this blog post, we will explore the benefits of using a subscription tracker, how it can help you never miss a payment or renewal date, and how it can help you stay on top of your finances. We will also delve into features that make these trackers indispensable, including keeping track of payments, managing debts, and maximizing your savings. Read on to simplify your financial life today

Simplifying Your Subscriptions

Subscriptions are everywhere these days- from Netflix to gym memberships, it can be challenging to keep track of all the automatic charges. But with a subscription tracker, you can simplify your financial life by managing all your subscriptions in one place.

Not only will this help ensure you never miss a payment or renewal date, but it will also aid you in identifying subscriptions you no longer use, saving you money in the long run.

Benefits of Subscription Tracker

A subscription tracker can help you in several ways, including:

Avoids late payments

A subscription tracker works by providing automated reminders of payment due dates, allowing businesses to plan ahead and ensure that they have adequate funds available to make payments on time. By using a subscription tracker, businesses can also reduce the risk of human error and improve their overall financial management processes.

Overdrafts fees

Subscription trackers allow users to monitor their subscriptions, bills, and other recurring expenses in one place, providing them with a clear overview of their financial obligations. By setting up alerts for upcoming payments, users can ensure that they have sufficient funds in their accounts to cover the expense.

Identifies subscriptions that are no longer necessary or unused

By keeping track of all your subscriptions in one place, you can easily review them and determine which ones you can cancel to save money. It’s not uncommon for people to forget about subscriptions they signed up for, which end up costing them hundreds of dollars every year. A subscription tracker will help you avoid this mistake and give you the freedom to cancel unnecessary subscriptions

Keeps track of payment and renewal dates

Using Subscription Tracker, you can easily keep track of payment and renewal dates for all your subscriptions and bills in one place. This way you won’t miss a payment deadline and incur late fees or penalties. You can also set up automatic payments to ensure that your bills are always paid on time, without having to worry about manually making payments every month.

Use the data from your subscription tracker to create a budget or savings plan

Once you have all your subscription payments tracked and organized with a personal finance tracker, you can use the data to create a budget or savings plan. Look at your monthly spending habits and identify areas where you can cut back on unnecessary expenses. Use the app’s budget feature to set limits for different categories of spending, such as groceries or entertainment. Make sure to prioritize essential payments like rent or utilities first, then allocate the remaining funds towards paying off debts or building up your savings.

Simplify your finances and reduce stress

Using a subscription tracker can also help simplify your finances and reduce stress. By having all your financial information in one place, you can easily monitor and manage your accounts. You won’t have to worry about missing payments or overdraft fees, as the app will send you alerts for upcoming due dates and low balances.

Additionally, having a clear understanding of your financial situation can alleviate the anxiety that comes with uncertainty. With a subscription tracker, you’ll have peace of mind knowing that you’re on track toward achieving your financial goals.

Conclusion

Thanks for reading our blog post!

A subscription tracker can help you simplify your finances and stay on top of all your payments. With features like automatic payment reminders, tracking expenses, and managing debt, you can streamline the process of managing your subscriptions.

By using a subscription tracker, you can also maximize your savings by taking control of unnecessary expenses. It’s time to take charge of your finances and start using a subscription tracker today.