How to Stay Organized with the Bills and Expenses?

Do you struggle to keep track of your bills and expenses? Are you tired of missing due dates and paying unnecessary late fees? It’s time to take control of your finances and stay organized.

Staying organized with bills and expenses can be a daunting task, but it’s essential for maintaining financial stability and avoiding unnecessary stress.

By implementing a few simple strategies, you can take control of your finances and avoid the stress that comes with missed payments or overspending.

Create a Budget

The first step to staying organized with bills and expenses is to create a budget. This will help you keep track of your income and expenses and ensure that you’re living within your means and identify areas where you can cut back, and save money for future goals.

It also ensures that you have enough money to cover your bills and avoid debt. By creating a budget, you can take control of your finances and make informed decisions about how you spend your money.

Track Your Spending

Tracking your spending is essential for managing your finances effectively. By keeping track of where your money is going, you can identify areas where you might be overspending and make adjustments to your budget.

This can help you save money and achieve your financial goals, whether that’s paying off debt, saving for a down payment on a house, or building an emergency fund. With consistent tracking, you’ll be able to make informed decisions about your money and take control of your financial future.

Set Up a Dedicated Space for bill documents

Setting up a dedicated space for your bill documents is essential to staying organized and on top of your finances. By designating a specific area in your home or office for bills, you can easily keep track of due dates, payment amounts, and any other important information related to your bills.

This can help you avoid missed payments, late fees, and other financial headaches. Whether it’s a folder in your filing cabinet or a section of your desk, having a designated space for your bills will help you stay on top of your financial responsibilities.

Use Digital Tools

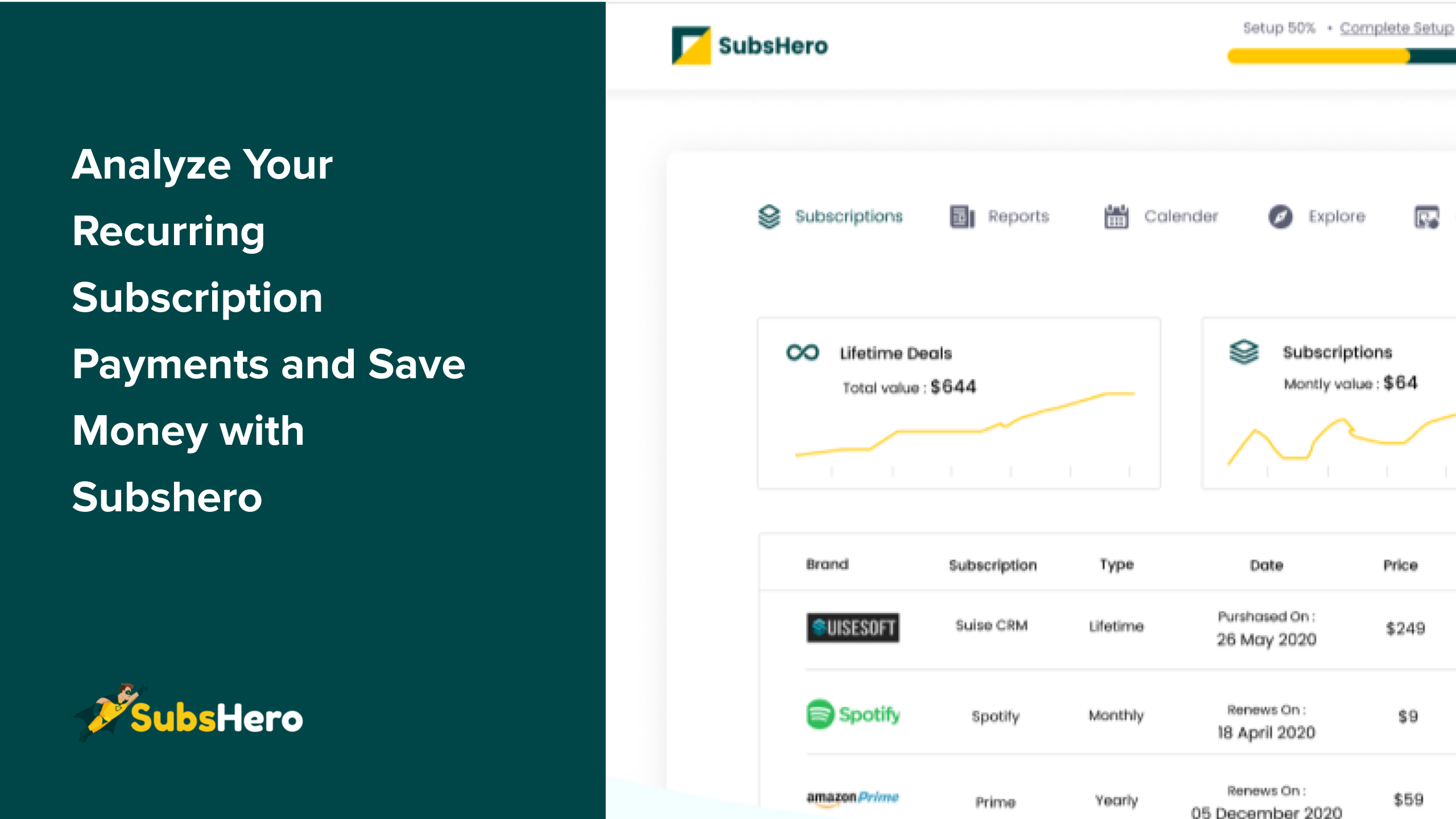

Digital tools have become essential for businesses to thrive in today’s digital age. One such tool is Subshero, a subscription management platform that helps businesses manage their subscriptions and recurring payments efficiently.

With Subshero, businesses can automate their subscription billing process, track customer data, and gain insights into customer behavior. This digital tool has become increasingly popular among businesses as it helps them save time and money while providing a seamless customer experience. By utilizing digital tools like Subshero, businesses can streamline their operations and stay ahead of the competition in the digital landscape.

Set Reminders

Setting reminders is an effective way to stay organized and on top of tasks. With today’s technology, it’s easier than ever to set reminders for yourself. Reminders can be set for anything from appointments to deadlines to important events. By setting reminders, you can reduce stress and ensure that you don’t forget anything important. It’s a simple but powerful tool that can make a big difference in your daily life.

Subshero is a great tool for setting reminders for important tasks. You can set reminders for meetings, appointments, deadlines, and other events. It’s useful for busy professionals who need to stay organized. Subshero is easy to use, and you can set reminders by entering the date, time, and relevant details. With Subshero, you’ll never forget an important task again.

Automate Payments

Automating payments is a practical solution for those who wish to save time and prevent late fees, both for businesses and individuals. Automated payments allow for the setup of recurring payments for bills, subscriptions, and other expenses, ensuring timely payments without the worry of forgetting.

Utilizing this method not only increases efficiency but also prevents possible charges for tardiness or violations. Automating payments can improve organization and facilitate expense tracking. Automating payments can be an efficient method to simplify financial management and reduce stress.

Separate Business and Personal Expenses

Maintaining a clear distinction between personal and business expenses is essential for any business owner. Combining the two may result in misunderstandings, incorrect financial documentation, and potential legal complications.

Separating your bank accounts, credit cards, and financial records for your business enables you to effectively monitor your finances, file precise tax returns, and uphold the credibility of your business. Establishing clear boundaries between personal and business finances from the start, and consistently following these guidelines throughout the life of your business, is crucial.

Regularly Evaluate Expenses

Evaluating expenses on a regular basis is essential for businesses to ensure financial stability and growth. The process entails examining all the costs of the business, such as fixed and variable expenses, in order to pinpoint potential areas for cost reduction or elimination.

Regular evaluation of expenses enables businesses to make informed decisions regarding budgeting, pricing, and investments. Analyzing expenses can assist businesses in identifying areas where resources can be better allocated for increased profitability. Regular expense evaluations can enhance business profitability and lead to long-term success.

Conclusion

Don’t let your finances give you a headache! Keep your bills and expenses organized to maintain financial stability and reduce stress. By utilizing these strategies, you can enhance your financial management and effectively monitor your finances.

Remember, organization is key to financial success, so start implementing these habits today and feel the weight lifted off your shoulders! Happy organizing!