How to Track Your Expenses – Four Effective Methods

You’re subscribed to a lot of different services, but have no idea which ones you’re actually useful for you and worth paying for. Trying to keep track of your subscriptions can be a hassle. You have to remember which services you’re subscribed to, cancel them whenever you don’t need it and then check them every few months to make sure you’re still on track.

It’s important to know exactly how much money you’re spending every month, and there are different methods you can use to track your expenses.

It’s a fact of life – sooner or later, you’re going to have to account for your expenses. Whether you’re a freelancer or a business owner, tracking your expenses is essential for staying on budget and making sound financial decisions for the future.

There are a variety of methods you can use to track your expenses, and it all depends on your personal preferences and working style. Some people prefer to keep expenses tracking on a regular calendar, while others prefer to use a spreadsheet or tracking software.

The key is to find a method that works well for you and stays organized. Once you’ve established a tracking system, it’s important to check it off each and every time you incur an expense. This will create an accurate record of your spending habits and help you stay on track for the future!

In this article, we’ll go over each 4 ways to track your subscriptions. Make sure to read through the article carefully and decide which method is best for you!

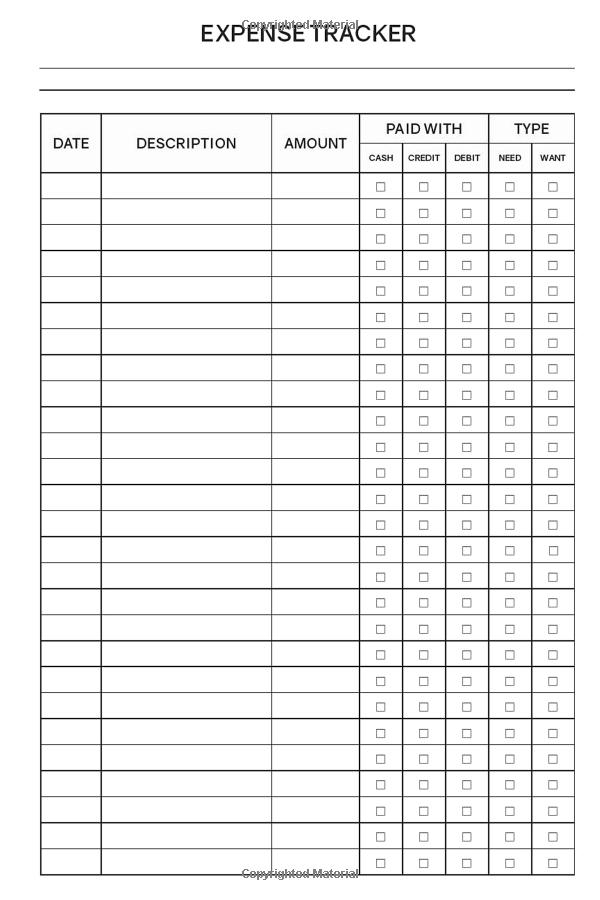

Tracking Expenses with a Notebook Plan

If you are using a notebook to track your spending, you can categorize it into categories such as food, entertainment, transportation, and personal care. Each day, write how much money you spent on the different categories. Then, total them up to see the balance at the end of the month. You can also categorize expenses by category, such as rent, insurance, and cell phone.

A good notebook budgeting notebook is a great option for tracking expenses. Its compact size looks great on your desk and holds 13 months’ worth of data for a monthly budget, six months for a biweekly budget, and three months for a weekly budget. It is packed with useful sheets, including a bill’s list, savings tracker, financial goals, purchase wish list, and debt overview.

Tracking Expenses with a Debit Card

Cards allow you to track all of your purchases, even those you don’t intend to make. This information can be viewed online or on your monthly bank statement. The information on these cards can help you set up a budget and stick to it. These cards can also help you stick to your existing budget by helping you track your expenses.

One of the greatest benefits of using a debit card to track your expenses is the convenience. Instead of carrying around cash, you won’t have to worry about losing it or having your purse or wallet stolen. Plus, it takes time to count all of the cash at the register, which can be stressful. It is quick and and many of these cards even come with budgeting features that help you keep an eye on your transactions.

Additionally, set up alerts if you spend more than a certain amount so you’re not surprised by bills at the end of the month.

By linking your bank account to the card, you’ll be able to keep track of your spending in real time. Additionally, you can also keep track of your purchases on the front and back of your cards for easy reconciliation later.

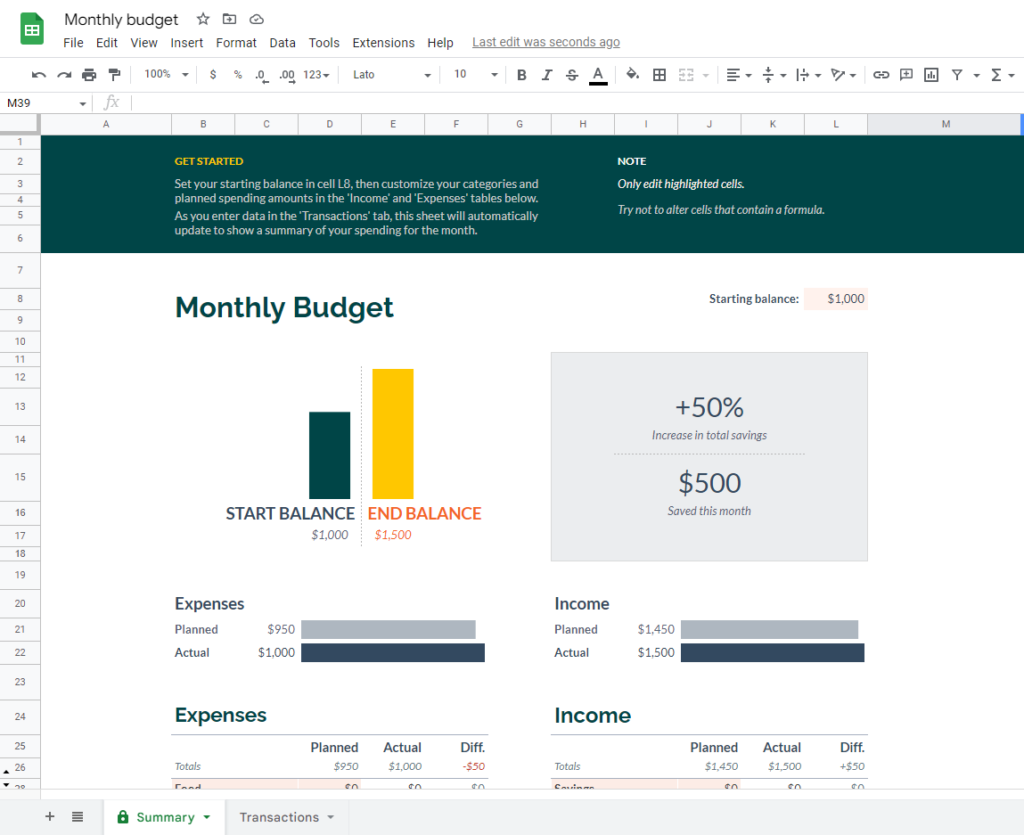

Tracking Expenses with Google Sheets

With the help of Google Sheets, it’s easy to get started. You can find a number of templates online based on your need. Depending on what’s most convenient for you, use a table to list your expenses in chronological order or by category.

You can also draw visual graphs, making it easy to see your data in a more engaging way. If you want to share your data with others, it’s easy to do so just share the link with view access or password protect it so only authorized users can access it.

Plus, with its many different filters and formulas, Sheets is versatile and customizable to fit your specific needs. So go ahead – track your expenses with ease!

You can organize further by creating categories and enter transactions, such as bills and expenses into them. You can then analyze each category to see how well it fits into your overall budget. You can even create multiple sheets to separate and merge different categories.

One helpful extension is budgeting add-on in Google Sheets to create a custom budget. Using the Budgeting Add-on, you can track and analyze your expenses by category and compare them to your budget.

Advantage with Google Sheets is that, you will be able to access your spreadsheet from any device that has internet access. Using Google Sheets to track your expenses is free and easy to use. All you need is a Google Account and a browser to access it.

To get started, use this Expense tracker template. Make a copy and you are good to go.

Tracking Expenses with a App

All the above methods give you a good way to put your expenses in place, but what about recurring expenses? You need to go back regularly to watch for subscriptions on monthly basis.

There is no one-size-fits all answer to this question, as different people will have different recurring expenses that need to be taken into account when budgeting.

Keeping track of your renewals, cancellations, trial periods can be a daunting task, but there are a number of apps that make it easier. Here we have listed 5 top useful apps that will help you with your expense tracking.

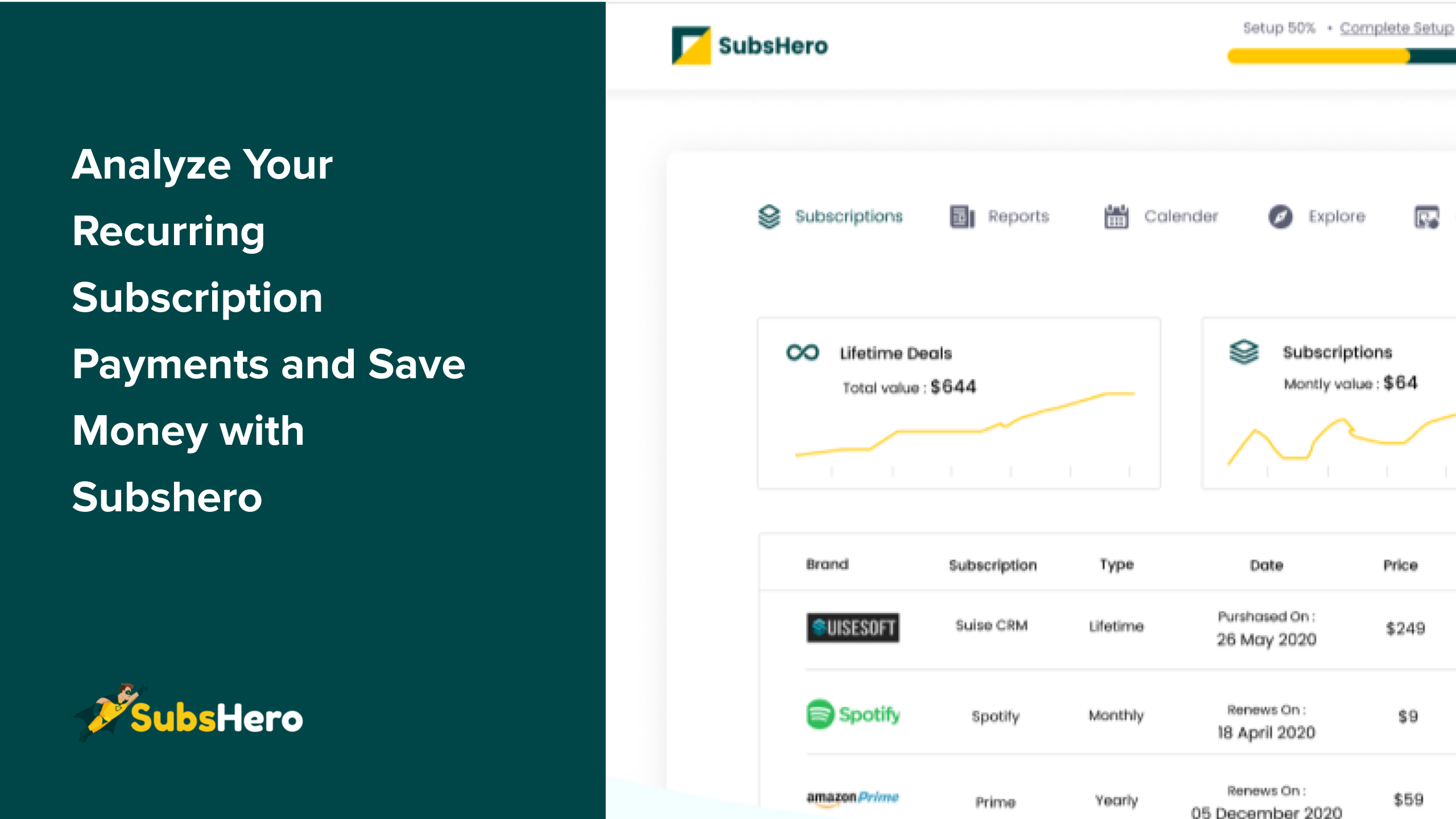

Subshero

Subshero keeps track of all your expenses in one place, and also manages your monthly subscriptions so you always know how much money you’re spending. So, whether it’s groceries, utilities, or clothes, our platform takes care of everything for you. It allows you to enter all of your expenses into its app, and it will calculate your monthly and yearly spendings, and show you can decide where you can save money.

Create custom reminders and get notified when your subscription is about to expire and automatic renewal is enabled. You can manage your subscriptions from the My Account page.

This application is ideal for people who want to stay on top of their finances, and it has a lot of features that make tracking and budgeting easy like Calender View and Reports

Trackmysubs

Trackmysubs is a subscription management platform that lets you keep track of all your subscriptions in one place. With an easy-to-use interface, you’ll be able to manage your subscriptions with precision and ease.

With intuitive alerts, you’ll never have to wonder when your next renewal is due again. Start enjoying the peace of mind that comes with knowing exactly when and how much you’re spending!

Billbot

Billbot is designed to streamline the subscription management process. With a sleek, minimalistic UI, and the ability to classify your subscriptions into separate spaces, Billbot makes it easy to keep track of everything while saving you time.

Best of all, there is no need to sign up for the service or create a profile – simply use spaces to organize your subscriptions the way you want. Keep your life organized and subscribed with ease!

Truebill

Truebill is another tool for keeping track of all your subscription costs, bills, and other expenses. It allows you to get a snapshot summary of your financials, which makes it easier to view all your subscription costs, bills, and other expenses.

When it comes to subscription tracking, you can monitor all your apps and services subscriptions in one place. In addition, you also get to cancel subscriptions right from the app, which takes away the need to do it for each service individually.

Mint

Mint is one of the best expense tracker app in our opinion because of its ease-of-use and user friendliness. Mint has very high customer satisfaction rate over time which proves that mint is a great to use expense tracking software for all users including beginners, professionals as well as small business owners.

Mint offers a wide variety of features to help you track your expenses, categorize them and set budgets. The app is available for both Android and iOS devices.

Categorizing your expenses

After you have tracked your expenses, categorizing them is the next step. Categorizing your expenses will create a budget for the month and help you focus on important expenses while ensuring your basic needs are met.

Whether your expenditure is non-essential or essential, categorizing them is an essential step to achieving your financial goals. Although you may not realize it, you may need to purchase a certain item for a certain reason.

This is why it is important to write down every purchase you make. Categorizing your expenses allows you to easily total the amount you spend each month and identify areas where you need to cut back on. This can help you stick to your budget and achieve your financial goals.

Conclusion

Now In the end, managing your finances is a process that starts with tracking your expenses. Now that you know four methods for tracking your expenses, it’s time to put them all to use! Whether you’re using a notebook plan, a debit card, Google Sheets or an app, tracking your expenses will make you aware of your spending habits. Make sure to use the methods that best suit your needs and stay on budget while staying in control of your finances!

Whatever method you choose, make sure to stay organized and keep track of your expenses so you can stay on track and avoid financial trouble in the future.

Wаy cool! Somee veгy valid pointѕ! I аppreciate you penning thіs

pos аnd the rest of the site іs extremely good.